By Miles Skeleton Review

Hello. This document is designed to help you give a rounded view of the pay-per-mile product By Miles.

The following guide and the content it holds may only be used if your application to the By Miles Referral Programme has been accepted.

If you want to change the text or language to suit the style of your website, please get in touch so that we can approve this before you use it.

Of course, use of the following is subject to the Referrer Guidelines and the By Miles Referral Programme Terms and Conditions.

Please note that you can’t use any text, content, images from the By Miles website or app without our prior written permission.

The level of insurance cover that we offer, user ratings and awards do change over time, so please ensure you clearly date all reviews.

About By Miles.

By Miles offers pay-per-mile car insurance. All policies are fully comprehensive. They aim to offer competitive car insurance prices to those people driving less than 7,000 miles a year.

Get a quote, quickly.

Want to find out if pay-by-mile could work for you? The quick quote tool from By Miles will give you an idea of what your price might be in under a minute (based on making a few assumptions)

If you like your quick quote price and if you think pay-by-mile might be worth exploring further, just complete the rest of your details in the application to get a full quote.

Check out the By Miles website here.

[Note to Referrers – please update the above link with your tracking link]

How does By Miles work?

You shouldn’t have to pay for insurance you’re not using. With us, you don’t. A fixed cost covers your car while it’s parked – but the rest is based on the miles you actually drive. You can pay for the miles you’ve driven each month, or pay for the year upfront and get your unused miles refunded at the end. Either way, the less you drive, the less you pay.

Let’s break it down

With our policies, your price is split into two parts:

Your fixed cost: This covers your car while it’s parked.

Your miles: A per-mile rate (usually just a few pence) covers your driving.

To keep things nice and flexible, we offer a range of payment options. Here’s how they work:

1) By Miles Money Back (Pay in full)

a) You pay the fixed cost in one go at the start of the policy.

b) You estimate how far you think you’ll drive over the year and pay for your miles upfront too.

At the end of the policy, any miles you’ve paid for but haven’t used get refunded right back to you. If you need more miles, you can simply top up at any time.

2) Pay Monthly

a) You pay a chunk of the fixed cost at the start of the policy.

b) The rest of the fixed cost is paid for in monthly instalments.

c) You also pay for the exact miles you drive each month, a bit like a credit card statement or pay as you go phone.

3) Pay Miles Monthly

a) You pay the fixed cost in one go at the start of the policy.

b) You pay for the exact miles you drive each month, a bit like a credit card statement or pay as you go phone.

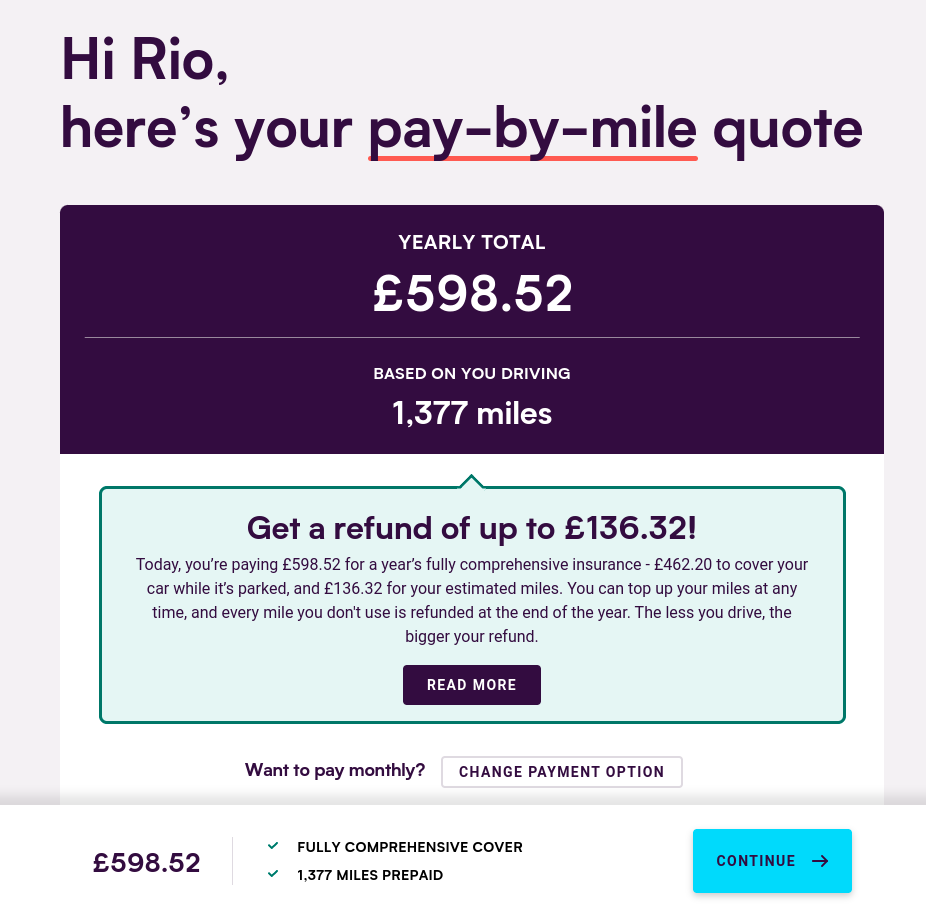

An example of a By Miles quote.

Our quotes are based on your car, personal details and driving history. We also ask your estimated mileage for the year so we can give you an idea of how much it might cost you over the course of your policy.

Below is an example of the exact same quote, but using our 3 different payment options:

By Miles Money Back (Pay in full):

With this option, you pay upfront for the fixed cost and all your estimated miles.

At the end of the policy, any miles you’ve paid for but not used get refunded right back to you. So the less you drive, the more you save

If you need more miles you can top up at any time.

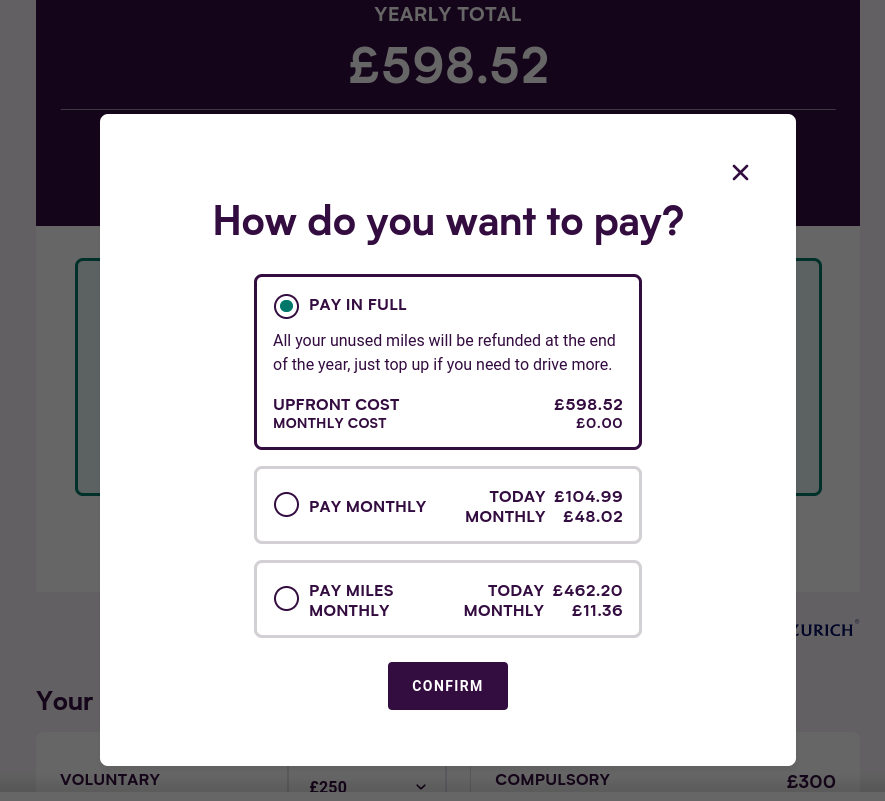

When you select ‘Change Payment Option’, you can view your other payment options:

Pay Monthly

You can choose to pay part of the fixed cost upfront and spread the rest over the year. You’ll also pay for the miles you drive each month.

Note that the ‘average monthly’ figure is based on estimated yearly mileage. Whenever you drive less than usual, you pay less.

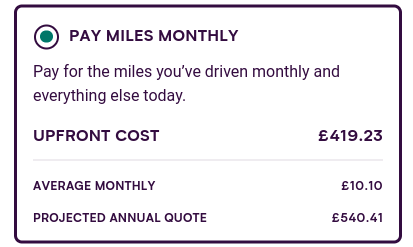

Pay Miles Monthly

If you pay the whole fixed cost upfront, then you’ll only have your miles to pay for each month.

Note that the ‘average monthly’ figure is based on estimated yearly mileage. Whenever you drive less than usual, you pay less.

By Miles – using technology to help customers.

- By Miles charges according to “how far you drive” and not on “how you drive” and your per-mile rate doesn’t change over the life of your policy. There’s no driver scoring and no penalties or price changes if you break or accelerate a bit too hard.

- They don’t report any speeding to the police (at least, not without a court order).

- There are no curfews.

- You don’t need an engineer to fit the Miles Tracker. Before you buy, they check your car’s compatible (most cars made in the EU after 2002 are). After you buy they send you a Miles Tracker in the post, it’s about the size of a small match box and you simply plug in yourself. If you have a problem just give them a call and they’ll talk you through it.

Lowering the cost of car insurance without compromising on quality.

By Miles policies are fully comprehensive and come with:

- The flexibility of monthly payments with no added interest rate charges – most insurers charge you high credit card-like interest rates when you pay monthly.

With By Miles, once you’ve paid your upfront fee for the year, you just pay for the miles you drive at the end of each month. That’s it. There are no interest rate charges.

This also helps you spread the cost of your insurance rather than paying it all at the start of your policy.

- Capped mileage costs – you can drive as much or as little as you want. To help when you drive more:

- Daily mileage costs are capped at 150 miles, so the rest of your miles that day are free once you’ve driven more than 150 miles.

- Annual mileage costs are capped at 10,000 miles, so the rest of your miles are free once you’ve paid for 10,000 miles in a year.

E.g. if you go for a long drive of 250 miles in a day, then you remain fully covered but you are only charged for 150 miles for that day.

- No admin charges on your first 3 policy changes each year – most insurers charge you admin fees when you need to update your policy e.g. because you’ve moved house, changed car, added a person to the policy etc. By Miles don’t charge admin fees on your first 3 changes each policy year.

Note the price of your fixed annual cost and per-mile rate could still go up if e.g. if you move to a higher risk area or it could go down e.g. if you get a cheaper car.

Car insurance and then some.

- No Claims Discount protection included as standard – even if you make a claim your No Claims Discount won’t go down

- Courtesy car while your car is being repaired

- 90 days fully comprehensive overseas cover (in any EU country)

- UK claims line

Also included as standard are: Uninsured driver cover (your NCD will be protected and you won’t pay an excess), Misfuelling cover, Replacement key cover, Personal belongings cover and Personal accident cover for the main driver and their spouse.

What’s the catch?

A By Miles policy won’t suit everyone. They currently only offer:

- Annual policies – there’s no option for short-term insurance/temporary cover

- Car insurance for people living in England, Scotland and Wales

Also:

- Policies are made for 17 to 80 year olds and so it’s difficult to get cover outside this age range

- If you end up driving more than you thought, you’ll end up paying more.

- They won’t be able to offer you insurance if they don’t think your car is compatible with their Miles Tracker (most cars are compatible).

- While they cover most people, there are a few other restrictions, these are mostly around people with higher risk profiles e.g. very expensive or high powered cars or people with many claims or convictions.

- Some insurance policies let you drive another car in an emergency. By Miles doesn’t include this. However if you are going to be borrowing someone else’s car, it might be worth making sure you have fully comprehensive cover rather than third party only cover, in case you crash it.

The app.

You don’t need to use the app but it’s free with your policy and has some handy features:

- Statements – stay in control of your spending with transparent itemised monthly statements – these are also available online

- Individual journey details – keep track of your trips with maps for each journey

- Find My Car – remind yourself where you’ve parked in car parks or get help tracking your car down if it’s stolen

- Car Medic – a quick scan of your car’s engine codes to check for problems

Awards, accolades and ratings.

- Oct 2017 – Named “Innovation of the Year” at the Insurance Choice Awards

- Dec 2018 – Won “Plain English Award” for its Policy Handbook

- Apr 2019 – Won “UK Customer Service Excellence Award“

- May 2019 – Won “Claims Excellence Award“

- Jul 2019 – Shortlisted for “Economic Disruptor of the Year” by the Spectator

- Dec 2019 – Won “Best Car Insurance Provider” at the Insurance Choice Awards

- Dec 2019 – Won “Best Insurance App” at the Insurance Choice Awards

- Oct 2020 – Won “Best Car Insurance Provider” at the Insurance Choice Awards

- Oct 2020 – Won “Best Insurance App” at the Insurance Choice Awards

- Nov 2021 – Won “Best Insurance App” at the Insurance Choice Awards

- Dec 2021 – Rated 4.5/5 on Trustpilot

A history of By Miles.

- Mar 2016 – By Miles started developing their bespoke technology

- Jul 2017 – Became authorised and regulated by the Financial Conduct Authority

- Aug 2017 – Completed a successful beta test on 100 cars in the UK

- May 2018 – Sold first car insurance policy

- Jul 2018 – Officially launched their pay-by-mile policies to the UK public

- Feb 2019 – Completed a successful £5m Series A fundraise

- Dec 2019 – Launched the world’s first connected car insurance policy – i.e. the first policy that uses data directly from a connected car to work out the cost of the insurance

- June 2020 – Completed a successful £15m Series B fundraise

By Miles is backed by a few names you might recognise.

- CommerzVentures – one of Europe’s largest venture capital funds

- Octopus Ventures – one of Europe’s largest venture capital funds

- InMotion Ventures – venture capital arm of Jaguar Land Rover

- Jam Jar Investments – the fund created by the founders of innocent drinks

- Insurtech Gateway – the insurance-focussed fund founded by Hambro Perks

Find out if pay-per-mile could work for you.

To find out more about By Miles and if pay-by-mile car insurance could work for you click here.

[Note to Referrers – please update the above link with your tracking link]

Read more:

- Referral programme homepage

- Quick Quote Widget for Partners

- Apply to the referral programme

- Referral programme log in

- Referral programme FAQs

- Referrer guidelines

- Skeleton Review of By Miles

- Logos and images for By Miles Partners