The world’s an expensive place right now – especially when it comes to driving. As well as inflation, factors like the global pandemic and Russia’s invasion of Ukraine are pushing up prices on everything from petrol to spare parts.

Here, we take you through what the outlook is for the cost of driving and – where possible – what you can do to save a bit of cash.

(We’ll checking back in to update this blog as things develop and try to ensure all the information is as useful as possible. It was last updated on 5/5/2022).

Contents.

Fuel.

Why are fuel prices so high?

Fuel prices hit record highs in April 2022. In large part, that’s Vladimir Putin’s fault. Before invading Ukraine, Russia was providing the UK with 8% of our oil demand. But, in response to the war, the government is moving away from importing oil from Russia.

That’s put up prices at the pump, but they were going that way already. As the world moved out of lockdown, demand for oil went up quickly – apparently quicker than suppliers were expecting. They’ve struggled to keep up, and when demand rises faster than supply, prices jump. On top of this, in September 2021, there was the move to E10, which is cleaner but more expensive than the previous standard unleaded.

The government tried to help motorists out by cutting fuel duty by 5p in March. We argued at the time that this wasn’t the best, or fairest approach. Unfortunately, it looks like we were right. In many cases, retailers have not passed this saving on to their customers, with prices falling just two or three pence, if at all.

When will fuel prices come down?

The honest answer is ‘who knows ?’ The future price of crude oil will have a lot to do with the actions of one man. Unfortunately, that man (Putin) doesn’t have anyone else’s interests in mind. The US Energy Administration released a short term energy outlook on the 12th of April 2022, in which they predict oil prices will start falling in the second half of 2022 into 2023. But they do put a dampener on that prediction:

“Actual price outcomes will depend on the degree to which existing sanctions imposed on Russia, any potential future sanctions, and independent corporate actions affect Russia’s oil production or the sale of Russia’s oil in the global market.”

There’s more to petrol prices than the cost of raw materials. As well as fuel duty (which has already been cut) 20% of what you pay is VAT (Value Added Tax). It’s not totally impossible that the government could lower VAT on petrol to help bring prices down, but it’s very, very, very unlikely…

This petition asking for VAT on fuel to be cut by 40% has more than 100,000 signatures. If you read the Government response, it’s obvious they don’t intend to cut VAT at all. Here’s the key quote:

“Whilst the rationale of this petition is appreciated, any reform to the current VAT treatment of road fuel would carry a significant cost to the Exchequer, and this should also be seen in the context of the over £50 billion of requests for reliefs from VAT received since the EU referendum.”

What can you do to save money on fuel?

Petitioning the Government to cut tax doesn’t look like it’s going to work, so the only real options within your power right now are to:

1) Cut out any car journeys you can.

When it comes to cutting out the odd car trip, you can find inspiration, here.

2) Drive as fuel efficiently as possible.

We’ve got a few good tips on how you can get more mileage from your tank (and help out the environment), here. And a few more fuel saving tips, here. There’s some interesting insights in this article by a champion ‘hypermiler’ (hypermiling is a sport where people compete to see who can drive with the best fuel efficiency).

3) Fill up on forecourts with the best prices.

In terms of finding the best price, the general rule is to go with the supermarkets. Their huge scale means they can negotiate better prices – something they’re keen to do as it’ll get you doing your weekly shop there. If possible, avoid filling up at motorway services. Their prices tend to be higher. That’s based on the fact they have to maintain 24-hour conveniences (and also the fact that if you’re running out of fuel on the motorway you don’t really have much choice).

New cars.

Why are new car prices so high?

Worldwide lockdowns left factories shut, reducing the global supply of computer chips. At the same time, demand for them went up, with people stuck at home buying up electronics. That created a supply problem that still hasn’t worked itself out – and might not until later this year.

These chips are a vital part of modern cars. Manufacturers desperately need them, now – but when the pandemic started, they bet the other way. Thinking demand for cars would drop off, they cancelled orders of chips – only it didn’t.

Since then, a string of unfortunate events have squeezed supply even more. A storm in Texas, a fire in Tokyo and a drought in Taiwan all shutdown major chip manufacturing facilities. To make matters worse, those selling the chips are prioritising faster selling items, like tablets and wearables.

When will new car prices come down?

Prices may have already passed their peak, but there’ll be a delay between supply issues getting sorted out and the market getting back to its pre-pandemic state. Some predict it’ll take until the middle of 2023, or even 2024. Unfortunately, Russia’s invasion of Ukraine could cause more supply issues.

What can you do to save money on new cars?

As the folks at Money Saving Expert point out, buying a new car is not a money saving move even at the best of times. But if you are dead set on some new wheels, but want the best possible price you could:

1) Wait.

The problems with supply discussed above will take a while to iron out. (There’s a backlog of people who’ve already put in orders for cars that haven’t even been built yet). So, as well as high prices, you’re looking at limited choice.

2) Think long term.

Think about the cost of owning the car, not just buying it. The car will be better value overall if it’s a model that:

- Is affordable to insure.

- Is highly reliable (check our MOT data report for some of the best performing options).

- Doesn’t depreciate in value too quickly.

- Is fuel efficient (which will also usually mean it’s cheaper to tax).

On that last point, it’s worth noting that the Government is already pushing hard to make electric vehicles (EV) viable for more people. There’s a £1,500 ‘plug-in grant’ for low-emission cars and a big push to get charging infrastructure up to scratch.

The war in Ukraine is only going to accelerate the move away from imported fossil fuels. That might mean more government incentives that benefit EV drivers – such as Ultra Low Emission Zones. Either way, comparisons like this claim that, over a four-year period, charging an EV is around 80% cheaper than filling a similar model with petrol. At the moment, that means saving around £600 a year.

3) Go ‘nearly new’.

Pre-registered cars are ‘used’ cars that haven’t actually been used. Sometimes dealers buy cars themselves to boost their sales figures – knowing they can sell them on later. Even though they won’t have been anywhere other than the dealership, the fact they’ve already been registered to an owner knocks a good chunk off the price.

On the one hand, it’s a good way to get a new car at a lower price. On the other, it goes to show how quickly new cars lose their value.

Used cars.

Why are used car prices so high?

As you’ve just read, when it comes to new cars, it’s not a buyer’s market just now. In 2021, sales of new cars were down 30% as compared to pre-pandemic years.

A lot of those people who were put off buying new, will have gone used instead. That bumps up demand – and that bumps up prices. You might have read that used car prices have been falling recently, and that’s true. In March 2022, prices were 1% lower on average than in January. But it’s important to remember the wider context – because that’s still about 30% higher than they were in 2021.

Why? The lack of supply of new cars means less vehicles entering the used market. And lockdowns boosted demand. Many people used the fact they had no choice but to stay in to save up money. It’s possible people who’d previously been using public transport may have decided they’d prefer to travel by car. All this led to a boom – and highly inflated prices.

When will used car prices come down?

The good news is, most commentators expect prices to at least ‘stabilise’ (stop rocketing, that is) this year. Supply will remain low for the next couple of years, so prices will only fall if demand drops a lot. That could happen – but only because the cost of living crisis may mean people simply can’t afford to make big purchases. Not exactly fantastic news.

What can you do to save money on used cars?

Assuming you need to buy now, the main thing you can do to save money is avoid a bad investment. It’ll sting to pay over the odds for a used car, even if it’s decent. If you get a dud, that’ll really hurt.

1) Trust your gut.

You need to remember that if something seems too good to be true, it probably is – especially in a market where sellers have the power. So look out for warning signs, such as:

- A lack of documentation around the car’s history and maintenance. (HPI checks can give you a very detailed record of the vehicle’s life, but cost £20.)

- A seller asking for cash, or wanting to meet somewhere ‘neutral’ like a lay-by.

- Worn tyres, stained interiors or other signs that maintenance wasn’t a high priority for the previous owner.

- Evidence of any problems that are known to be common for that particular model.

- A bad vibe in general. Go with your instincts.

2) Think of the other costs.

As with a new car, think about the cost of running it too. What mileage will it do on a full tank? How much will it be to insure? A ‘cheaper’ car might be quite a bit more expensive in the medium or long term.

Parts and repairs.

Why are prices so high for car repairs?

The shortage of new cars and the high prices for used models, mean people are sticking with their cars longer. As the average age of cars on the road goes up – so does demand for maintenance and repairs.

This, along with the knock-on effects of Covid had created a parts shortage (separate to the computer chip shortage). This piece is discussing the US market, but is still relevant to the UK. Here’s a key quote:

“A lot of shops are overwhelmed because demand for repairs is at an unprecedentedly high level […] many are working less efficiently because of the parts supply shortage […] many shops are working short-staffed because technicians are not available to hire […] to slow down the deluge of requests and make up the dead time waiting for parts, many shops have raised their rates.”

The war in Ukraine will only make matters worse:

“The main Ukrainian parts industry comprises vehicle wiring looms and gas production that supports the manufacture of semiconductors. This is going to cause issues with the supply of major components supplied to many vehicle manufacturers which will impact new vehicle production.”

Manufacturers that have parts manufactured in Ukraine have been particularly affected – MINI being one example.

When will prices come down for car repairs?

Overall, the price rises for maintenance and repairs are closely tied to the price of cars in general. So, it’s likely a similar outlook – but with the war being a factor, it’s hard to say.

What can you do to save money on car repairs?

1) Make sure you’re covered.

If fate has an expensive bill in store for you, you certainly won’t want to be footing it. If you happen to be on a third-party only policy, or one that doesn’t offer a decent level of cover, it could be a good time to up your insurance. That could hugely reduce the cost of being in an accident.

2) Prove fault.

If you do have fully comp cover, the other way to reduce the cost of a claim is not having to pay any excess. A dashcam can be a really handy way to show your insurer that you weren’t at fault. If you can do that, your insurer should be able to recover your excess from the other side and pay it back to you.

On the subject of claims, anytime you’re in an accident, think PRANG:

- Pull over somewhere safe.

- Ring your claims line.

- Avoid admitting any kind of blame.

- Numbers – get contact details for everyone involved.

- Gather evidence, such as photos and video.

If you’re looking at repairs caused by general wear and tear (which are almost never covered by insurance) there’s not much you can do. Sorry about that.

Crime.

Why is car crime rising?

Because it pays better, now. With the prices of new and used cars on the rise, thieves are targeting them more often. Car thefts rose 3% overall in 2021, but even if criminals don’t get away with your car, they might steal an important part of it.

The prices of the precious metals that are used to make catalytic converters have soared, so organised gangs are going after them. Hard.

We’ve already covered the recent rise in catalytic converter theft in a lot of detail, so give that link a click.

Airbags are another item of the car thief’s wish list. They’re stolen a lot less often than catalytic converters, but instances are on the rise – up 68% since 2020. As we’ve mentioned above, garages are facing higher costs – so it looks like some of them are happy to take stolen parts if it means a better deal.

When will it stop?

Most of the crimes discussed above are carried out by organised gangs. The type of crimes they focus on at any given time depends on how easy they are to pull off and how much they pay. Car crime will probably drop when the price of vehicles and parts comes down – or if a much easier scam comes along.

Of course, if your car is the one that’s been targeted, it won’t make much difference to you if that’s part of an upward or downward trend. It’s going to be rubbish either way. It’s worth making sure you’re doing what you can to protect your car.

What can you do to avoid being a victim of car crime?

There’s plenty you can do to put thieves off.

1) Always lock your car.

You can also get locks for your steering wheel and your catalytic converter. Make sure these are approved by Secure by Design (and let your insurer know before you make any changes to your vehicle). Make sure the windows and sunroof are closed and valuables are not on show.

2) Park somewhere secure.

If you can’t park in a garage, try to make sure your car is somewhere well-lit and ideally in view of CCTV. If you can park in a position that makes your tailpipe hard to reach (like up against a wall) that makes life harder for catalytic converter thieves.

3) Install an immobiliser.

If your alarm/security system doesn’t come with an immobiliser, you could either upgrade or have one fitted.

4) Get a tracker.

We know from experience that these work. Our Find My Car feature has helped us recover 75% of the vehicles our members have had stolen.

5) Use tamper-resistant screws and nuts.

Criminals love to get their hands on licence plates (it means they can fit them to their vehicles and avoid being tracked). Tamper resistant screws make it harder for them to take your plates off. Specially designed nuts do the same for wheels.

Insurance.

Why are car insurance premiums going up?

On average, premiums had been steadily falling for a good while up until late 2021. Unfortunately, now, they’re on the rise. In fact, they went up 4% just in the first three months of 2022. There are two main reasons for this- the number of claims being made, and the cost of the claims being made.

It’s hardly surprising that claims are on the up. The less people drive, the less accidents happen (that’s the whole idea behind our pay-by-mile model of insurance). Compared to the long periods of lockdown we’ve seen recently, there are far more people on the roads now. We’ve also just come out of winter that saw a series of strong storms hit the UK. Each of those brought a wave of claims (which is why we urge you to be extra careful in wet, cold and windy weather).

The rise in crimes like those discussed above are also leading to more claims.

Many types of claims are also now cost more for insurers to handle. As we’ve discussed above, repairs are more expensive and take longer. Given that the cost of paint has soared since 2021, even covering over a scratch is more expensive than it was.

But, insurers don’t just pay for repairs. They’ll often cover the cost of a courtesy car while yours is out of action.

These cars generally come from car hire firms. During the height of the pandemic, many of these firms cut down the size of their fleets (which weren’t much in demand, given all the travel bans). With car prices shooting up, getting back to normal has been either expensive or impossible – so the prices they charge have gone up too (as much as 40%).

The fact the cars are a lot more expensive to provide, and are needed for a lot longer than usual makes things more expensive for insurers.

When will car insurance premiums come down?

Premiums should fall a bit as and when the shortage of parts and cars settles down. Claims may also go down in the next year or so as rusty drivers get back into the swing of things.

What can you do to save money on car insurance?

There are still lots of opportunities to save. You’ll find most of these apply even in the best of times, so they’re worth knowing about.

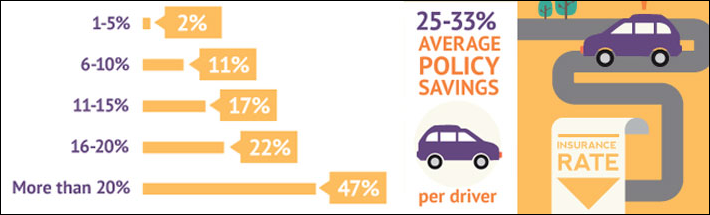

1) Shop around. Always.

Until this year, this rule was absolutely golden. Traditional insurers (not us) loved to put up prices for existing customers, saving their best deals for new ones. New rules to end car insurance loyalty premium mean providers now have to offer existing customers the same deal they would if they were new. Even so, it’s important to shop around. Moving to one of the insurers with the cheapest price for you still leads to a typical saving of £100. For what it’s worth, Finder.com say 51% of people could save over £300 by switching to By Miles (as of April 2022).

Shopping around is much easier using comparison sites. If you get a quote you like the look of, keep hold of the email. The company will have to honour that price for 30 days, even if prices go up.

2) Break with tradition.

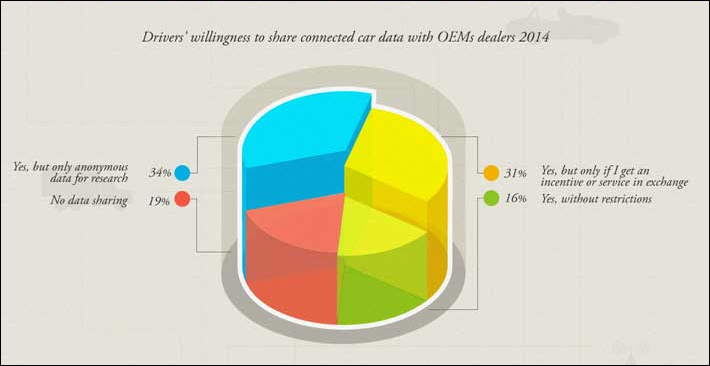

All insurers base their prices on data – but not necessarily the same data. Traditional insurers look at their historical claims to see if they can figure out how likely someone might be to claim based on what’s happened in the past with customers they have things in common with. They’ll never see you drive, but they’ll come up with an idea of how risky you are to insure based on your job title, age, address and other things like that. In short, they work off stereotypes.

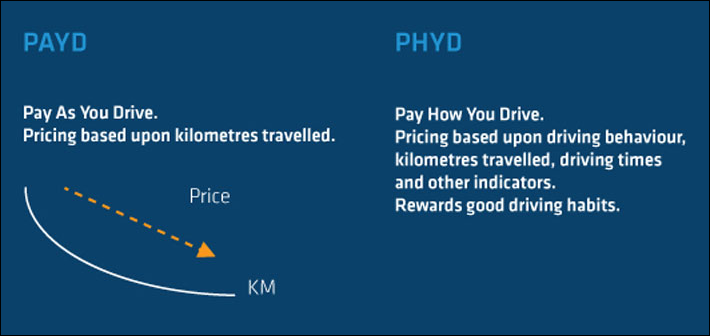

New insurers ask these questions too, but they often combine it with information about your actual driving. Some use telematics devices to collect data on things like your speed and how hard you brake to give you a ‘driving score’. If your scores are low, you’ll get lower premiums.

Some insurers (like us) don’t pay attention to how you drive – just how far. We know that the less time you spend on the road, the less likely you are to have an accident. It’s why our policies are pay-by-mile. If you’re not a high mileage driver, it could well be worth getting a quote.

3) Check your voluntary excess isn’t too low.

The excess is the part of a claim that you have to pay yourself. As a general rule, the higher you set it, the lower your premium will be. Remember, if you set it so high you can’t afford to claim, you’re not really getting any benefit from your insurance. And however safe a driver you might be, there’s no telling if you’ll be the unlucky one a bad driver smashes into.

4) Look into multi-car policies.

If you need to insure two cars, it can work out cheaper to put them on the same policy instead of insuring them separately. If one of them is rarely used, it might make sense to go with pay-by-mile insurance for your second car.

5) Get on the electoral roll.

Insurers like to know who they’re dealing with. If your identity is easy to verify, it can actually get you a cheaper premium. Making sure you’re on the electoral roll helps with that.

Well, that wraps it up. If you’re not a high mileage driver, one great way to save is to make sure you’re not overpaying for car insurance. Why not get a quote and see if a pay-by-mile policy could work for you?