Estimating your annual mileage when you apply for car insurance is tricky business. Here’s how to avoid being overcharged.

In theory, if you drive fewer miles, then you should pay less for car insurance. This is because your insurer believes you’re a better risk, as you’re spending less time on the road. After all, you’re not very likely to be involved in a car accident when your car is parked on your driveway.

Of course, if you underestimate your mileage, you run the risk of getting into trouble with your insurance company. But overestimate your miles – as many do – and you might end up paying too much to cover your car.

Pay-by-mile car insurance is based on the idea that people who drive less should pay less. With cover from By Miles, you’ll never have to guess your annual mileage again – you can measure it, and pay for it, exactly. Here’s why that’s important.

Guessing your annual mileage can make your car insurance more expensive.

Calculating your annual mileage accurately can be difficult, as there are so many factors that can change throughout the year that could affect it.

For example, you may only be commuting a few miles a day by car if your workplace isn’t far from home. However, if you start work in a new office that’s 20 miles further away, your annual mileage would obviously increase dramatically. Would you remember to update your annual mileage estimate on your car insurance policy? Probably not. It’s no wonder, then, that a large proportion of motorists end up randomly guessing their mileage.

Recent research suggests that over a quarter of UK motorists have admitted to estimating their mileage while applying for a car insurance quote, rather than putting in what they believe to be an accurate number. There are a few reasons that this is a problem, but the biggest one is that these people could be losing themselves money.

Comparison website uSwitch surveyed 2,000 motorists, and found that they typically overestimated distance by 15%. If you travelled 10,000 miles in one year, the overestimation would be of around 2,100 miles. That’s potentially going to add a hefty chunk of additional expense to your car insurance quote.

Not to mention, incorrectly guessing your annual mileage can actually invalidate your policy. This would mean that your insurer could technically refuse to pay out in the event of an accident, which could then result in you footing a huge repair bill yourself.

Traditional car insurance doesn’t always take mileage into account the way you think they should.

It gets even more complicated when you realise that traditional car insurance companies have never been able to check how many miles you drive.

Our joint car insurance research with MoneySupermarket shows that even if you underestimate your annual mileage, you can end up paying more than a motorist estimating a higher annual mileage. Work that one out.

Why do lower mileage drivers pay more?

While it’s difficult to prove, it may be that your car insurer thinks you’re lying to try and get cheaper car insurance. Therefore, they charge you as if you were actually going to be driving much more.

Don’t believe this is really happening? Try it yourself.

If you have a policy with a traditional car insurer, ask them how much difference it will make to your price if you drive a few thousand more miles in the year. You might be surprised to see that it may not make any difference to your price at all, which means you were already paying as if you were driving those additional miles…

How to (sort of) accurately calculate your annual mileage.

One method that you could use to reasonably calculate the annual mileage is looking at your past few MoT documents, which will tell you how many miles your mileometer says you’ve driven since your last MoT examination.

You could then just take an average of those amounts for the last few years. Don’t have the paper MoT documents anymore? No problem. By looking at the online DVLA MoT database, you can pop in your registration plate and see your car’s mileage for the last few tests. That should help provide you with an estimate.

If you want to play it really safe, you could take the highest annual mileage your car’s travelled over the last three years, and use that (or a slightly higher) number for your quote. If you’re even more diligent, you could make a note of your mileage when you take out a new car insurance policy, and then look at how many miles you’ve travelled when the car is up for renewal.

Of course, if these numbers vary massively, then it’s probably not wise to rely on them. Perhaps the simplest method of working out a quote is to figure out how many miles you usually drive in a day – by monitoring your driving for a few weeks, then working out the average – and then multiplying that number by 365.

For example, if you travel six miles in a day, you can assume you’ll travel around 42 miles a week, which would equate to around 3,000 miles in a year. If you travel 42 miles a day, you would travel 294 a week, and 16,000 miles in a year.

Why pay-per-mile car insurance may save you money.

Of course, none of the methods listed above will give you a figure that’s 100% accurate. If you use any of these methods, you’re running the risk of being penalised by higher car insurance costs, or worse, invalidating your policy.

We wanted to make all this much simpler with our pay-by-mile car insurance policies.

If you take out a By Miles policy, we ask you for a fixed cost upfront, which comprehensively covers your car while it’s parked up for the year.

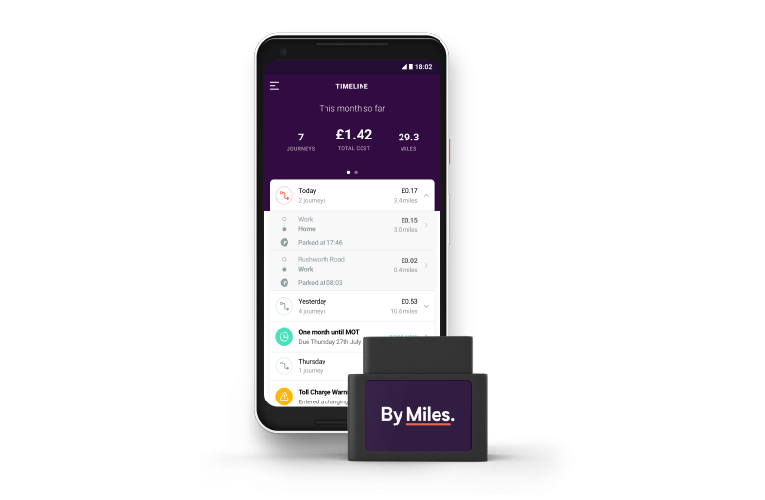

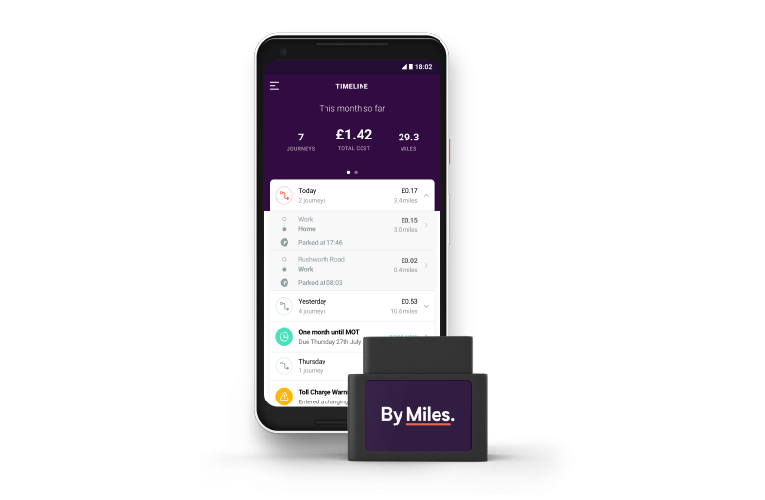

After that, we just count exactly how many miles you drive throughout the year with our Miles Tracker, so that we can charge you each month based on your actual mileage.

We think that’s fair.

Your mileage estimate is just an estimate, and that’s fine.

With By Miles you still give us an estimate of your annual mileage when you get a quote, but that’s only so we can give you a prediction of how much your annual car insurance will be.

How much (or how little) you drive is totally up to you and you remain covered at all times.

Importantly, there is no penalty if you drive more or less than your estimate. If you drive a less, you’ll actually pay a less than the original prediction. If you drive a little more then you just pay a little more.

Also – because the mileage is charged at the end of each month – that puts you back in control of your monthly budgets.

We estimate that motorists who drive under 7,000 miles a year will pay less for their car insurance with a pay-by-mile policy like the one we offer – especially if you’ve been roughly guessing your mileage in the past.

Why not get a quote today and see if you could save with a fairer, more flexible kind of car insurance?