We know that the UK’s annual mileage fell sharply in 2021. Unfortunately, since then the cost of living crisis has taken hold. In May 2022, we found that around 66% of folks were actively looking to save money on driving – now that’s up to nearly 80%.

Most of us are driving (even) less.

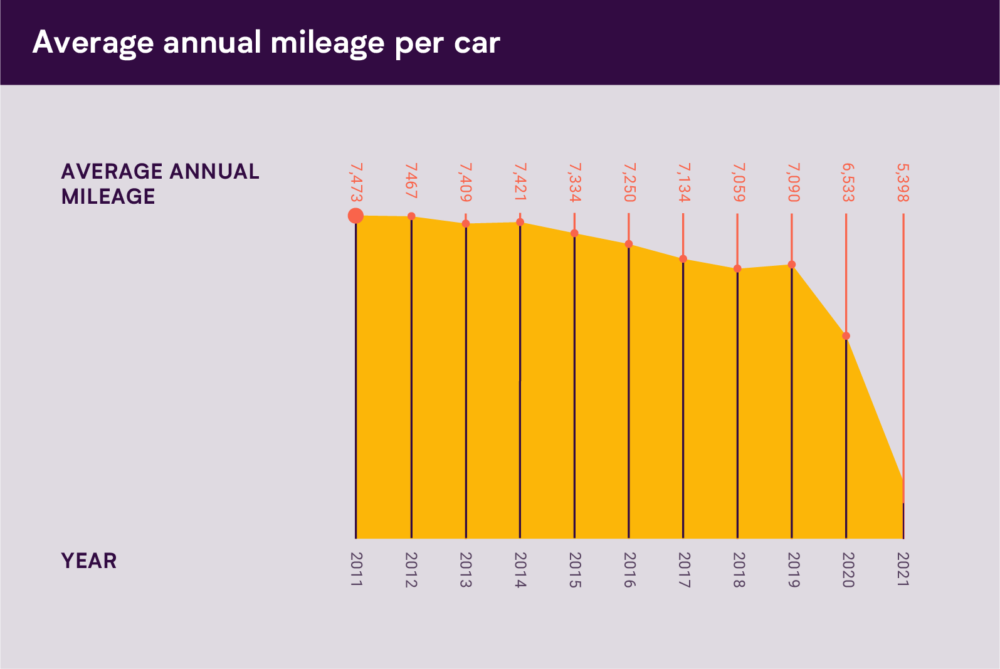

The UK has already become a low mileage nation. These days, three quarters of people drive under 7,000 miles a year – a figure that until recently was considered about average. The state of the economy is only pushing that trend further.

According to our latest survey, over 30 million road users are looking for ways to cut the cost of driving. In more than half of cases, that’s meant choosing to drive less. Likewise, around half of people are looking for ways to drive more economically.

As inflation is still impacting everything from the price of fuel to repairs, it’s not surprising that we’ve seen this leap in the number of people attempting to tighten their budgets.

We asked people of various backgrounds and ages all over the country how their driving habits had changed in response to the rising cost of living.

What are we doing to save money on driving?

| Using the car less. | 30% |

| Checking tyres are fully inflated (for fuel economy). | 25% |

| Walking more. | 24% |

| Looking for cheaper car insurance. | 23% |

| Driving more smoothly to improve fuel economy. | 21% |

| Aggregate: used car less or alternative transport more. | 51% |

| Aggregate: driving more economically. | 47% |

This gives a pretty clear picture of what’s going on across the country as a whole. But not all demographics are feeling the pinch in quite the same way.

Under 35s are going further (and not by car).

We found that 84% of people in their mid thirties or younger have acted to avoid the costs of driving. Compared to the average, this group are:

- 5x more likely to use a car sharing scheme.

- 4x more likely to use an e-scooter.

- 2.5x more likely to use an electric bike scheme.

- 2.5x more likely to drive without insurance.

- 1.5x to take up cycling.

- 1.5x more likely to delay repairs to their car.

This group are keener to keep costs down – even if it means leaving their cars parked. That’s another sign that this generation may end up driving far less than the one before. And that would mean average mileages continuing to fall over time. This will be one of the factors shaping the future of driving – and the way car insurance works.

What can you do to save money on driving?

If, like most people, you’re trying to make your money go further, these tips should help:

Insurance: If you’re driving less, you’ll save money on petrol. Shouldn’t the same go for insurance? We certainly think so. That’s why our policies are pay-by-mile. If you’re not a high mileage driver (and you’re probably not) get a quote and see if you could save. Even if pay-by-mile isn’t for you, it makes sense to shop around. Here’s how to get a great deal on car insurance.

Driving: You can find more tips on fuel economy here, but the key is to avoid hard braking – or any stopping and starting that you possibly can. Picking the right road can help too. This blog includes some good reasons to go by motorway.

Other ways of getting around: Some tips to help you make less journeys by car, and perhaps more by bike.

Fuel: You can’t control the price at the pump – so getting the best deal is about picking the right pump. Motorway driving is often the most fuel efficient way to drive, but you won’t want to fill up at the services. Supermarkets are usually a good amount cheaper.

SORN: If you aren’t driving at all you can obtain a SORN – meaning you won’t have to tax it or pay insurance.