According to Fairer Finance, our members are happier than most. That’s music to our ears – but what exactly is it about our pay-by-mile cover that has people smiling?

Making a difference where it matters most: Price.

Almost everything has gotten more expensive in recent years. Unfortunately, the costs that come with supplying car insurance have gone up well above inflation. As a result, premiums across the industry have gone up by about 60% on average.

In that context, giving people a price they feel good about is more important than ever (even if it is that bit harder). So we’re really proud to say that, as well as being named best for customer happiness by The Times, and in the top 5 providers for customer happiness overall by Fairer Finance – they’ve also named us number one when it comes to happiness based on price. In a recent report, Fairer Finance found that:

“By Miles had the highest proportion of respondents who were happy because of the low price (82%).”

(The article ‘Motor insurers with the happiest customers revealed’ was written by Dr. Oliver Crawford, the Head of Research at Fairer Finance and appeared on the Insurance Post, behind a paywall.)

Unlike traditional insurance providers, our pay-by-mile cover rewards people who don’t use their cars all that much (which is an awful lot of people). It’s great to hear our members are loving the control and value they get from doing things a little differently.

How does pay-by-mile car insurance?

If you’ve never tried a By Miles policy, here’s how it works. You pay a fixed amount to cover your car while it’s parked, but the rest depends on how much you drive.

You can pay for your miles each month, or estimate your miles for the year and pay for them upfront. We refund any prepaid miles you haven’t used at the end of the policy – so you never pay for more than you actually drove.

Here, Nick, one of our members, describes the monthly option:

Recently, we’ve tweaked our model a bit. We’re looking to reduce the fixed part of our premiums as much as possible. That means more of the cost is linked to your driving – so every mile you drove under your estimate would save you a bigger percentage of the overall price.

Keeping it simple.

Different doesn’t have to be complicated. To us, helping people who drive less to pay less for car insurance makes clear sense. We want our policy documents – and all our communications – to do the same. And it sounds like we’ve managed that.

Fairer Finance have put us top of their league table for clear policy documents, saying:

“By Miles has the lowest reading grade (calculated by assessing the average word and sentence length), meaning that its terms are relatively easy to digest.”

To be honest, this wasn’t much of a surprise. In the past, we’ve won awards for our use of good old plain English.

But that isn’t the only way we like to keep things simple. Updating policy details is straightforward, as you can do it yourself using the app – with no need to call (and there’s no admin fee for the first 3 changes you make like that). And staying on top of things is a breeze, as we show all your journeys – and their cost – in the app.

If you do need to make a longer journey? No sweat. We cap our daily charges at 150 miles. So if you needed to drive, say, 300 miles in a day (ouch!) half of that journey would be free.

Offering more than cover.

Car insurance is something you buy hoping you’ll never have to use. But even if you never claim (fingers crossed), we think you should get value from your policy every day. So, as well as offering cover rated 5-star by Defaqto, we also offer handy app features…

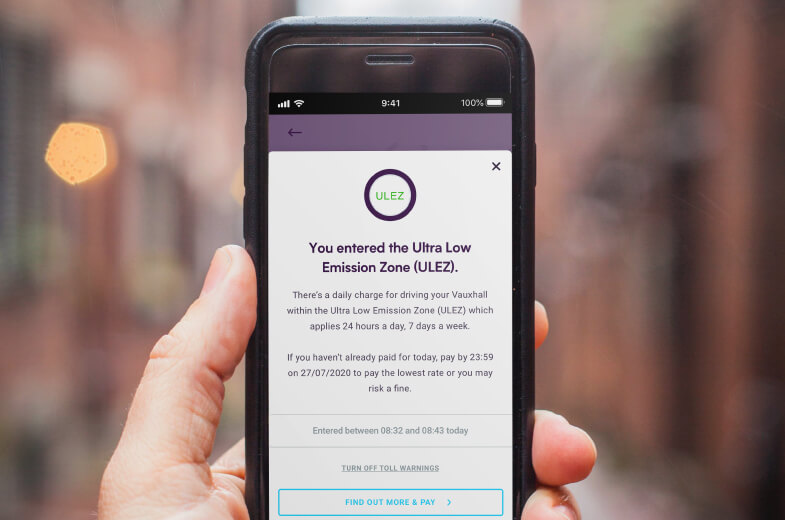

Find My Car can help you get back to your parking spot, or even foil thieves. Car Medic runs diagnostic tests so you can scan for error codes and spot problems with your car. Our toll reminders mean you won’t get caught out for charges like ULEZ – and with chat, you can talk to our team about any questions you might have.

If you’re a lower mileage driver, why not get a quote and see if you could save.