Ghost broking is a growing problem in the car insurance industry, with thousands of drivers a year duped into taking out policies that aren’t worth the paper they’re printed on.

Here we spell out:

- What a ghost broker is

- How they work

- How to spot them

- And what we intend to about them

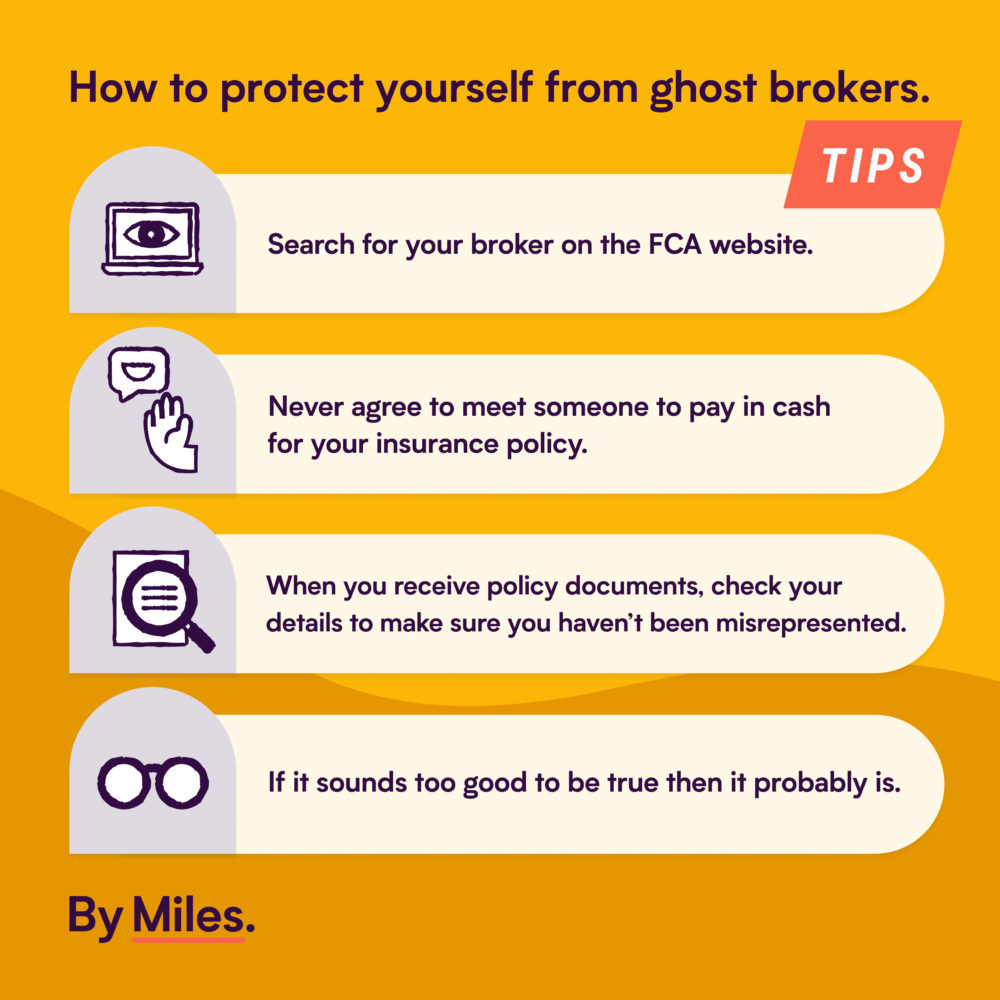

Not got time for all that? Here are our top-tips right off the bat:

You may already have some idea of what these scammers are all about – or maybe this is your first time hearing about them. Either way, you’ll want to be clued up about their schemes, because the costs involved can be life changing.

So how can drivers protect themselves from falling victim to a ghoulish ghost broker? The first step is knowing what a ghost broker even is.

What is a ghost broker?

An insurance broker is like a personal shopper for cover. They find you a policy that fits, and you pay for the service. Hopefully, they get you a deal so good that you end up saving a bit despite their fee – but either way, it should be less time and effort for you.

Ghost brokers mimic this service. They’re called ‘ghosts’ because – much like their supernatural namesakes – the policies they deal in don’t actually exist. The ghost broker will often be able to present their client with a certificate of insurance, but when you lift the sheet off its head, all is not as it seems.

They entice customers with promises of incredibly low prices. Cash and time-poor drivers think they’re getting a great service at a knock-down price. In reality, the “policy” they get (note the scare quotes) could end up leaving the driver in a world of bother should they need to claim.

If you’re involved in an accident and it turns out that you’re not properly insured, you could be liable for the repair or medical costs of both sides – and could even face being hit with points on your license or prosecution.

So how are they able to offer rock bottom prices, and still produce insurance documents for the customer? And why are the policies they provide worthless?

How do ghost brokers work?

There are a number of ways, but usually the criminal will just change some of the customer’s details when getting them the quote. Using this false information, they can get a (seemingly) great price.

We’ve seen examples of brand new BMWs being passed off as a 50cc moped, and a 19-year old being quoted as a 50-year old librarian.

You don’t need to know a great deal about car insurance to know that a bookish 50-year old on a low-powered moped is likely to be offered a lower premium than a 19-year old in a brand new Beamer. So you can see how this deception benefits a dodgy broker: they make it look as if they’ve found you a fantastic deal, but it’s based on lies.

Another common trick is cancelling the policy as soon as it’s started. All your documents will arrive, but the broker will then cancel the policy and pocket your cash – leaving you completely uninsured and at risk of being pulled over by the police.

Both of these methods will leave you with “real” (there are those scare quotes again) documents in your hand. You’ll even be able to see that your car is insured on the Motor Insurance Database. But the policy will either be invalid or cancelled. By the time you’re on the hard shoulder exchanging details with another driver or the police, the ghost broker will be long gone with your money – leaving you to pick up the pieces.

Don’t think this is something you’d fall for? Well, the bad news is you don’t even have to be tricked by a ghost broker to be left out of pocket by them. Insurers have to factor fraud into their pricing, so these scams bump up premiums for all drivers.

How do I spot a ghost broker?

As someone who’s worked to help people spot a fraudster for much of my career, I’m still amazed by the lengths these criminals will go to. Just when you think you’ve cut off one avenue, they pop up again in a different guise. In the past, ‘Dave, down the pub’ might have cornered you and offered to sort your insurance out for a couple of hundred quid. These days they’re increasingly turning to social media.

And that makes a lot of sense. A lot of younger drivers are desperate for affordable cover and are used to buying on social platforms. Better yet (for the crooks) these younger drivers may not have much experience of how insurance – or its pricing – works.

The adverts ghost brokers post on social media are pretty outrageous.

An unsuspecting driver who’s just been quoted thousands on a legit price comparison website can be forgiven if they stop scrolling when they the same cover at a fraction of the price on Instagram. Unfortunately, these unbelievable prices are exactly that: not to be believed.

What can you do to protect yourself?

As we explain a little further down the blog, we’re going into ghost-busting mode and starting a campaign to stamp out this particular kind of crime completely. Until then, here are a few things you can do to make sure you don’t fall foul of a ghost broker:

- Always double-check that your broker is legitimate by searching for them on the FCA website.

- Ghost brokers will want to try and keep things ‘off-grid’, so never agree to meet someone to pay in cash for your insurance policy.

- If you receive policy documents, check the details to make sure you haven’t been misrepresented. In some instances, you won’t even be able to pass your insurers’ security checks if your details have been altered significantly.

- Finally, remember, if it sounds too good to be true then it probably is. Use comparison sites to work out what an average price for your risk looks like, and if you spot a quote that’s a lot lower, approach with caution.

What do we intend to do about it?

We think it’s time that the social media giants helped out in the fight against fraud. Drivers are having to fend for themselves on the wild west of social media, while these cowboys run riot. (Cowboys? Ghosts? Either way, they’re baddies.) That’s not fair – so we’re not having it.

We want to see social media platforms actively searching-out and removing ghost brokers from their platforms today – not just waiting until legislation forces them to. We’re spreading the word far and wide to keep consumers safe and informed – and to pressure platforms into acting. Watch this space…(and keep on eye on the press too!).

If you’re a lower mileage driver interested in taking control of your insurance costs, pay-by-mile might be worth checking out. So, why not get a quote?