Three. The number of courses in a slap-up meal, lions on the shirt and members of the chipmunks. It’s always been special, but now that we’ve won our third consecutive Insurance Choice Award for Best Car Insurance Provider, the magic number feels extra magical.

First things first: thank you! This award is decided by your vote rather than industry insiders – which is precisely why it means so much to us. But, why exactly do we keep winning (and winning and winning) it? And where do we go from here?

To find out, we put together a series of questions (three of them, obviously) designed to shed some light on what’s going on here at By Miles towers. And, to celebrate the magic number even further, we’ve got three different answers for each question – provided by three of our best and brightest team members.

Wow, three in a row! Why does this wonderful thing just keep happening?

James Blackham, Chief Executive Officer:

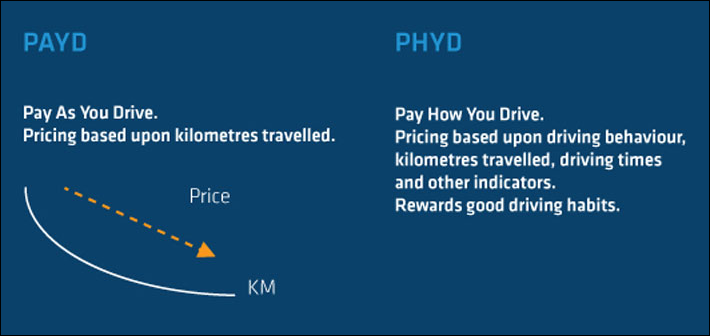

The whole idea behind By Miles was to rethink insurance in a fairer way. That’s why we went with pay-by-mile pricing – it’s an intuitively fairer way of doing things. And if you’re a lower mileage driver, it can be a lot cheaper as well. Ultimately, I think we keep winning because we keep saving people money and offering a great experience too.

As we’ve grown, we’ve invested in our customer experience team. That’s meant that we’ve been able to maintain the very human connection we’ve always had with members – to make sure they feel looked after. App features like our ULEZ charge notifications play a role too – our members know we’re looking out for them, beyond just offering a great price.

AJ Singh, Chief People Officer:

Everything we do is done through the lens of our company virtues: fairness, efficiency, ambition, growth and respect. We treat our customers and members the way we treat each other – and I believe they really feel this in their interactions with us.

Our culture is non-negotiable. It’s something we all genuinely buy into and I think that lends authenticity to our brand, our communications and our decisions. All in all, I think our membership knows that we truly care.

Kirsty Wilmot, Head of Product:

The simple answer is, we won because people voted for us! We’re really honoured that people find our product and the service we provide useful enough for them to want to do that. (It’s pretty motivating, actually!)

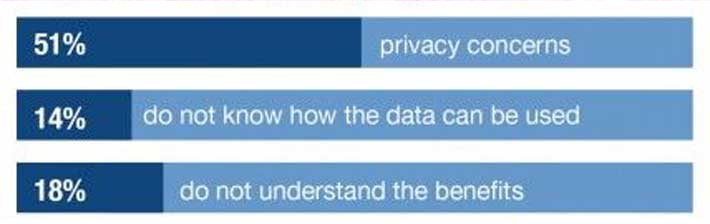

I guess it comes back to fairness. That’s really where our passion lies. There’s just so much guesswork woven into the way that traditional insurance works, and that inevitably leads to unfair pricing. We’ve developed a product that lets us do things in a smarter way, and charge people a price that’s based on their actual usage, and I think people appreciate that.

What do you think has been the biggest step (or leap) of the By Miles journey so far?

James Blackham, Chief Executive Officer:

It was totally unforeseen, but I think the way our product worked during the pandemic was a really important moment. While, obviously, it wasn’t something we wanted to see happen, it really helped benefit our members – who weren’t driving and therefore saving. All the while, other insurers were hoovering up profit, because their customers paid the same, even though they weren’t getting into accidents. That clear cut unfairness was something we campaigned against, but I think it worked in our favour and really helped people see that pay-by-mile car insurance is the way forward.

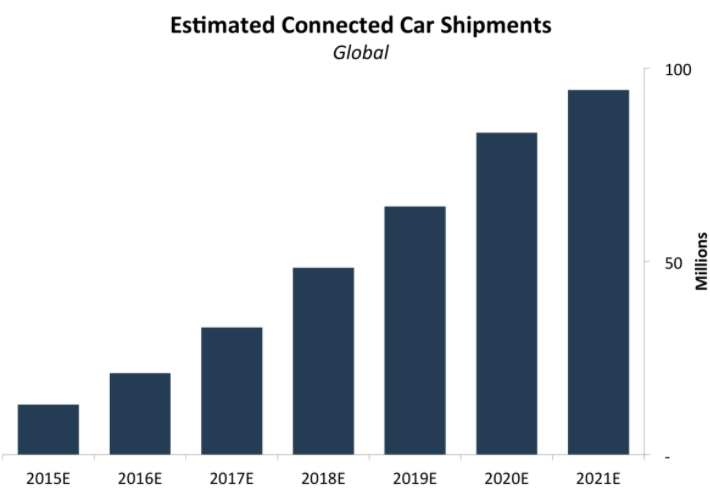

Aside from that, launching the world’s first connected car policy with Tesla was an amazing achievement. We can now collect mileage data directly from vehicles, without any need for a Miles Tracker. It’s put us in a great place to leverage the next generation of smart vehicles.

AJ Singh, Chief People Officer:

Since early 2020, we tripled in size from 25 to 75 people. For me, the biggest achievement wasn’t necessarily that we were able to bring in so many talented people (though that was obviously great!) – it was the fact that we were able to go through that rapid growth while maintaining the ethos we started from.

Despite the fact that we’ve grown so rapidly, we’ve never lost sight of who we are or how we want to turn up for each other – even with the pressures of the pandemic. In fact, the measures we put in place to protect everyone’s wellness and productivity during lockdown were definitely a major milestone. In a recent engagement survey, 98% of employees said they felt supported in hybrid working (basically being more flexible between working from home and working in the office). And I don’t think it’s a coincidence that the same proportion (98%) rank By Miles as a great place to work.

We’re doing the right things for our people and that’s really helping us to keep delivering for our members.

Kirsty Wilmot, Head of Product:

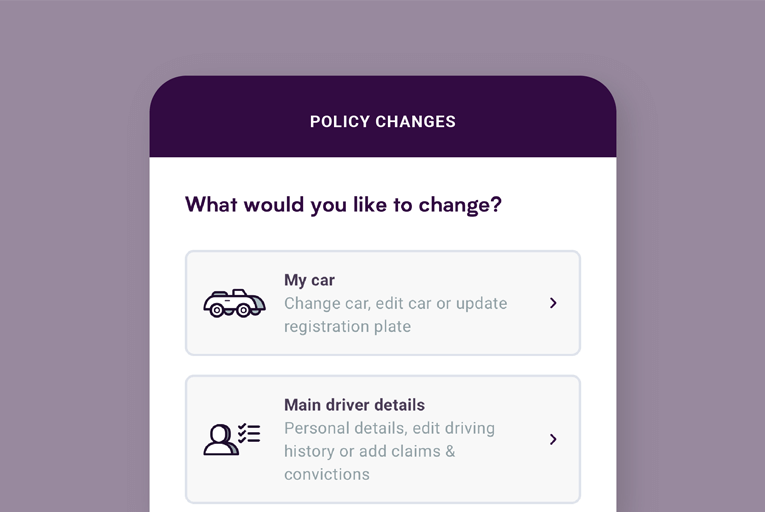

There have been so many! Fair pricing is at the core of what we do, but we’re always trying to go beyond that. It’s been really rewarding seeing app features we’ve built making a genuine difference for members. I vividly remember the first time our Find My Car tool led to a member getting their stolen car back. It was great to think we’d been able to help them out in their time of need. Since then 75% of our members who’ve had a car stolen have been able to recover it thanks to the app! Moments like that really drive home how much of a positive impact our product actually have on people’s lives.

There’s a lot on the horizon for By Miles. What are you most excited about?

James Blackham, Chief Executive Officer:

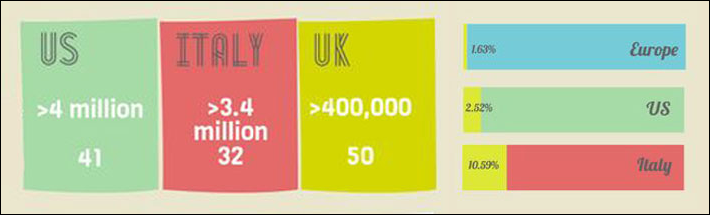

The average mileage of UK drivers has been falling year on year for a long time now – and I certainly wouldn’t bet against that trend continuing. I’m excited that, as we continue to grow, we’re going to be in a position to help more and more of those lower mileage drivers get the value they deserve.

We’re also excited about the general shift towards electric vehicles (EV) that we see coming over the next few years. We’ve been working to get ahead of the curve and make sure we’re offering a great option for EV drivers. We’ve done some good work already (our specialist Tesla policies, and the fact we cover charging cables as standard, for example), but there’s plenty more in the pipeline.

AJ Singh, Chief People Officer

2022 is going to be a year of growth on all fronts. Unfortunately, it also looks like it’s going to be another year where our team and our members are dealing with all the uncertainty that Covid brings. We’re looking forward to finding even more ways we can be flexible, supportive and inclusive and provide a great environment to be part of – whatever the wider world might have in store.

Kirsty Wilmot, Head of Product:

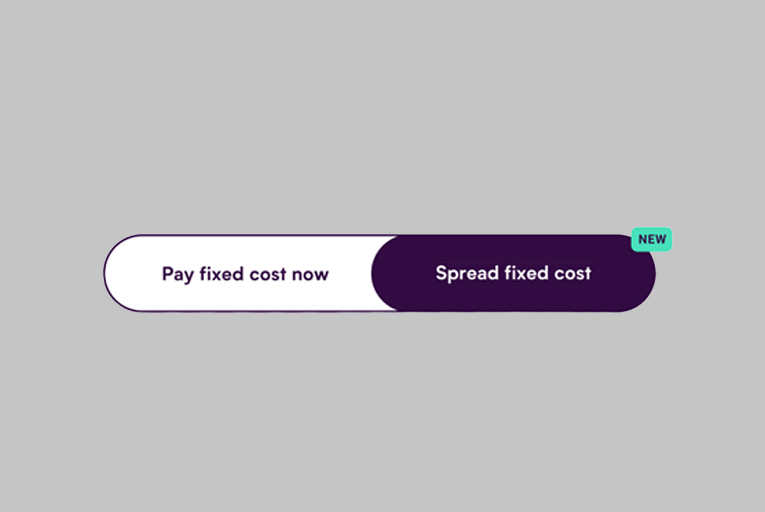

We know that our product provides a fairer deal for a lot of lower mileage drivers. At the same time we understand that paying for miles on a month by month basis doesn’t work for everyone – even if they don’t drive very much. Without giving away too much away at this stage, we’re working on some exciting new products and optimisations that should help us meet the needs and budgets of even more lower mileage drivers. Fundamentally flipping the way insurance works on its head isn’t easy, but it’s all worth it when we see such a wide variety of people finding a By Miles policy that works for them.

Obviously, this isn’t just a case of guessing – or telling – people what they need. We’re going to be co-creating these new products with the help of our members. So, I’m really excited to get everything we’ve been working on into their hands so we can start getting their feedback and insights!

If you’re a lower mileage driver looking for an award-winning insurance provider, you’re in the right place. So, why not get a quote?